The European Central Bank introduced “tiered” remuneration for bank reserves in October 2019. Since then, bank reserves at the ECB have doubled, but the tiering methodology has remained unchanged. There may be reason to revisit it

Tiered remuneration on reserves: how does it work?

Bank reserves at the ECB have been subject to negative rates since June 2014. In late 2019, the ECB decided to exempt some bank reserves from this negative rate. The “exemption allowance” was set at six times required reserves (plus required reserves themselves, making seven times required reserves in total). Required reserves, in turn, are a percentage of deposits and other short-term liabilities that banks have issued to the general public. So loosely speaking, if households or businesses deposit an amount of money at a bank, then the exemption allowance for that particular bank increases by 7% of that amount (seven times the required reserve ratio of 1%), allowing it to have more reserves at the ECB without facing the negative deposit rate. If banks extend credit to the real economy, this will also create more deposit liabilities for banks, which in turn increases the amount of reserves that banks can park at the ECB without paying negative rates.

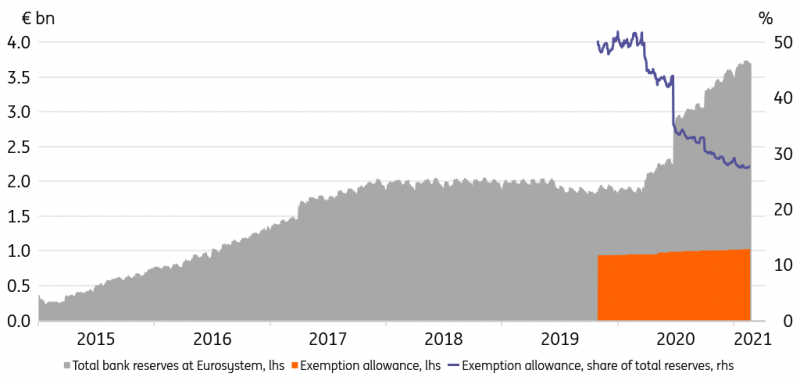

The exemption allowance share of reserves has almost halved

The share of bank reserves exempt from negative rates has dropped from 50% in late 2019 to 28% today

When the exemption allowance was first enacted, about half of all bank reserves at the ECB qualified. Yet as the pandemic struck Europe, the ECB conducted new TLTRO operations, restarted its Asset Purchase Programme (APP) and implemented an additional Pandemic Emergency Purchase Programme (PEPP). Together, these programmes caused bank reserves at the ECB to double in a year’s time to over €3700bn today. The exemption allowance increased as well, in tandem with bank liabilities. But the allowance increase came nowhere near the increase in total reserves, and as a result the exemption allowance share has dropped from 50% in late 2019 to 28% today (see chart below). The negative rate costs that banks incur over their reserves has correspondingly increased. Has the time come for the ECB to review its exemption parameters?

Bank reserves at Eurosystem and exemption allowance share

For “involuntarily” held reserves only!

One could ask, why would the ECB give a free gift to banks in the form of negative rate exemptions? An answer to this justified question could be: indeed the ECB should only provide relief for reserves that banks cannot avoid holding. It should not be so generous with reserves that banks voluntarily choose to hold. The latter applies e.g. to reserves that are created as a consequence of TLTRO-borrowing by banks. The costs and benefits of those reserves should be assessed in conjunction with the TLTRO borrowing rates the ECB applies.

It seems neither necessary not warranted to exempt reserves that are a consequence of TLTRO loans

If banks don’t like paying the negative rate costs on these reserves, they should repay their corresponding TLTRO loan. The fact that many banks choose to keep their TLTRO loans, shows that the benefits exceed the negative rate cost of holding the corresponding reserves. It therefore seems neither necessary not warranted to exempt reserves that are a consequence of TLTRO loans.

But how about reserves that banks cannot avoid? Asset purchases (APP and PEPP) are an ECB initiative. While it could be argued that banks indirectly benefit as asset purchases contribute to a healthier economy and compress credit premiums, in a direct sense they lead to higher bank reserves and associated negative rate costs. Isn’t this like the government obliging people to hoard toilet paper, and then proceeding to tax toilet paper holdings? The box below explains in more detail why asset purchases necessarily lead to higher reserves that banks collectively cannot avoid, and how this differs from the reserves over which banks do have influence.

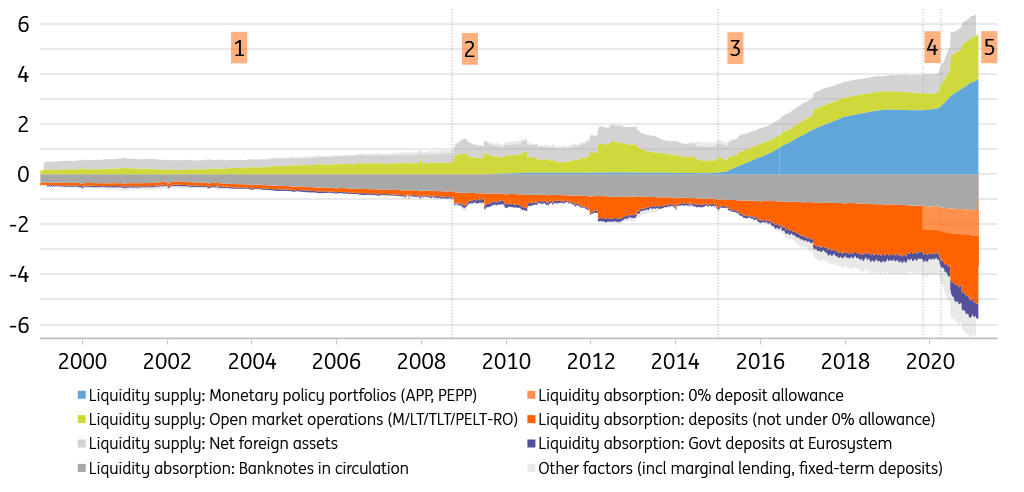

Monetary operations since 1999: the ECB’s Money Trumpet

To explain today’s glut of excess reserves, it helps to briefly review the history of the ECB’s monetary policy operations. In an effort to present geeky monetary stuff as something cool, we’ll refer to it as the ECB’s Money Trumpet. The chart below shows supply and uses of liquidity in the base money market – the market where central and commercial banks interact – from the perspective of the Eurosystem’s balance sheet. We won’t attempt to summarise the ECB’s monetary operations in just a few paragraphs, but the Money Trumpet shows five phases of ECB liquidity policies in action. Key to understanding this chart is the law of double-entry bookkeeping dictating that any asset acquired by the Eurosystem (liquidity supplied to the market, recorded above the x-axis) is matched 1-on-1 by a Eurosystem liability increase (liquidity parked at the Eurosystem, recorded below the x-axis).

ECB Money Trumpet: Eurosystem liquidity supply and absorption (€ tr)

1. 1999-2008: the good old days

The first phase runs from 1999 until 2008. During this time, Eurosystem liquidity was steady and predictable. The Eurosystem made sure liquidity was always tight, meaning there was net demand for liquidity from banks. By offering liquidity sources in scarce quantities, the ECB could steer money market rates. The auctions of ECB liquidity supply (the open market operations) were capped, meaning that banks were oftentimes only allotted part of what they had asked for. The flipside of this was that bank reserves at the ECB were low as well. Aside from the required minimum reserves, “excess” reserves tended to be minimal.

2. 2008: switching to full allotment

As the interbank market dried up in 2008, maintaining tight liquidity in the system became too risky. The ECB instead switched to full allotment auctions, allocating banks whatever credit they asked for. Indeed Eurosystem claims on banks under open market operations increased. Bank reserves at the ECB increased in tandem. The abundance of excess reserves meant that at least the financial system would not be brought down by liquidity shortages, even as interbank lending had all but stopped.

3. 2015: fighting the deflation demon

The policy goal of achieving flush liquidity with full allotment auctions remains in place today. But in 2015, the ECB added another element. It embarked on large-scale asset purchases (in fact asset purchases had started in 2009 already, but on a limited basis only). Indeed, bank reserves at the ECB increased in step with asset purchases. Excess reserves in the system ballooned.

It is here that our distinction becomes clear between reserves that banks hold by choice, versus reserves they cannot avoid. The ECB’s auctions (open market operations) had always resulted in liquidity supplied at the request of banks. The resulting bank reserves were thus driven by bank demand. The newly introduced asset purchases however are “supply-driven”. They are initiated and controlled by the Eurosystem. They too result in bank reserve increases, but not at the request of the banks, nor do the banks have a choice here. They can merely try to push the hot potato around between them, but they cannot influence the total amount of reserves created by ECB asset purchases.

4. 2019: introduction of tiered remuneration on deposits

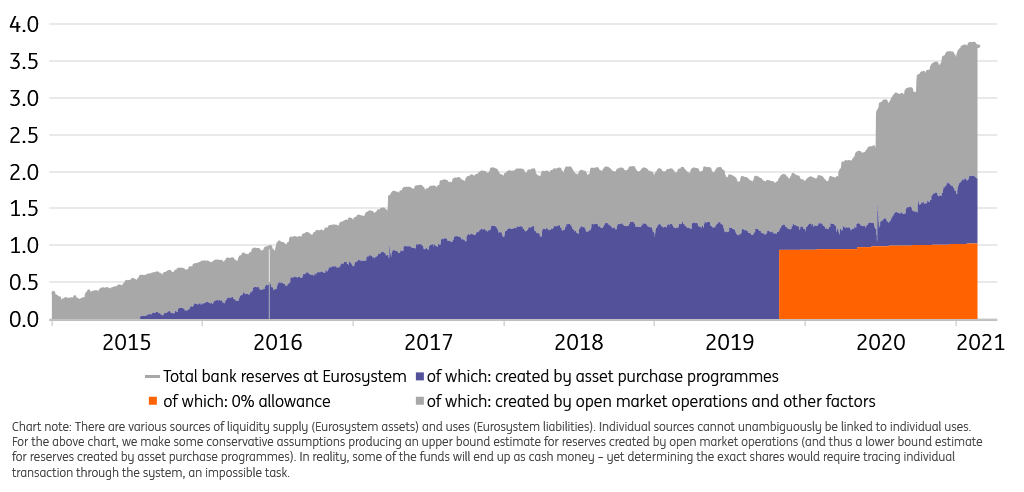

The ECB decelerated and then stopped its large-scale asset purchases in 2018. As the ECB continued to reinvest maturing assets, excess liquidity in the form of bank reserves at the ECB stabilised, but did not drop. In September 2019, the ECB introduced a two-tier remuneration system for excess liquidity, to “support bank-based transmission of monetary policy”. The first tier, the allowance of currently six-plus-one times required reserves, is exempt from the negative deposit rate. The light orange part in the chart below shows the estimated exemption allowance. Note that in practice, exemptions are calculated per individual bank, and may therefore be lower for some banks (if their excess liquidity remains below their allowance). Therefore, the shown aggregate allowance should be interpreted as an upper bound estimate.

Bank reserves at Eurosystem, attributed to liquidity sources (€ trn)

5. 2020: Renewed asset purchases and TLTROs

In April 2020, the pandemic prompted renewed asset purchases plus an expansion of long-term refinancing operations. Bank reserves increased from €2046bn on 31 March to €3740bn today and with further asset purchases and TLTRO operations in the pipeline, the end is not in sight.

Thanks, but how do ECB asset purchases drive higher reserves?

When the ECB (strictly speaking, the Eurosystem) buys a government bond or any other asset directly from a bank, it credits the bank’s reserve account. As such, the ECB’s balance sheet lengthens: it acquires an asset (the bond) and a liability (increased reserves). When the ECB buys a bond from e.g. a pension fund, more steps are involved, but the effect on reserves is the same. As the ECB acquires the asset, it credits the reserves of the bank where the pension fund has an account. The ECB instructs the bank, in turn, to credit the pension fund’s bank account. The pension fund may move the deposit to another bank or reinvest in another asset, but this does not reduce the reserves in the system. The reserves created by the asset purchase are an ECB liability, and can only be reduced at the ECB’s discretion, if it decides to sell the bond again (or to not reinvest the principal when the bond matures). Of course, individual banks can try and reduce their reserves, but total reserves in the system (insofar as they are created by ECB asset purchases) are determined by the ECB.

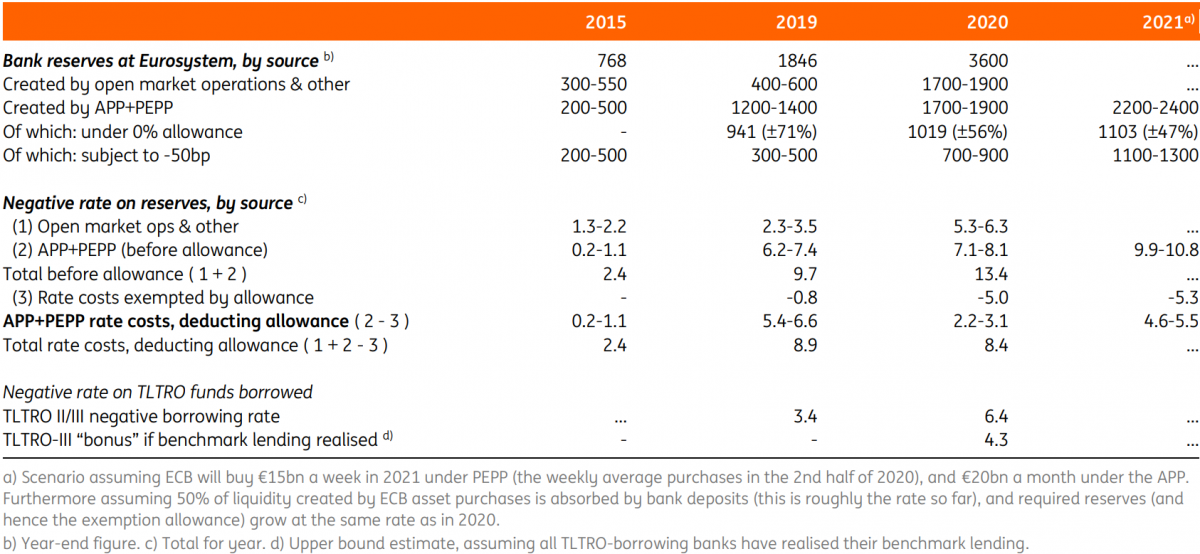

Without further measures, the negative rate calculated over involuntarily held reserves could almost double this year

Armed with this knowledge about the role of monetary operations and asset purchases, we can now split bank reserves into a voluntary and involuntary part. We do this by allocating reserves to these two sources of liquidity. This allocation cannot be calculated to the last euro, therefore we provide a range estimate based on different liquidity attribution assumptions. The exempted allowance amounted to roughly 70% of “involuntary” bank reserves in late 2019. As the ECB restarted its asset purchase programmes in 2020, the share of the exempted allowance in “involuntary” reserves started to fall, reaching about 50% currently and set to fall further in the year ahead. Without further measures, the negative rate calculated over involuntarily held reserves could almost double this year, from about €2.5bn in 2020 to some €5bn in 2021.

Bank reserves at Eurosystem, attributed to liquidity sources (€ bn)

But isn’t the TLTRO negative rate borrowing compensating for all of this?

So, you may say, this complicated reasoning about where reserves come from is all very well, but if banks meet their TLTRO benchmark lending, then the negative rate they pay on their reserves is in fact more than compensated for by the negative rate they get paid on their TLTRO borrowing – at least in 2020 (see table). So why worry about negative rates on reserves?

Indeed over the past year and TLTRO iterations, the ECB has progressively lowered the TLTRO borrowing rate further into negative territory. The most recent TLTRO-III offers a base borrowing rate equalling the deposit rate (-50bp). This means that the negative borrowing rate banks receive on their TLTRO borrowing, and the rate they pay on the corresponding “voluntary” reserves, cancel out. In other words, the negative rate costs for banks associated with the “voluntary” reserves are matched by TLTRO borrowing rate revenues. This leaves the involuntary reserves.

The TLTRO “bonus” rate is not meant to address negative rate costs of reserves. It serves the separate goal of incentivising bank lending to the real economy

Yet with TLTRO-III, the borrowing rate drops to -100bp if banks succeed in attaining a certain benchmark lending to the real economy. As can be seen from the table above, this “bonus” rate revenue (€4.3bn) exceeded APP+PEPP rate costs in 2020 (€2.2-3.1bn), provided benchmarks have been reached, which is likely the case for most banks, though not all.

Yet this TLTRO “bonus” rate is not meant to address negative rate costs of reserves. Instead, it serves a separate policy goal, namely “incentivising bank lending to the real economy”. In our view, one instrument (the TLTRO rate in this case) can serve only one policy purpose at a time. This goal should not be conflated with the issue of involuntary reserve costs.

Besides, there are composition effects to take into account: the banks that take out TLTRO loans and those that hold the highest reserves, are not necessarily the same. Moreover, whether banks will reach their benchmark lending in 2021 too, remains to be seen. Business credit demand has been weak in recent months, and the outlook isn’t great either. Given all these considerations, a review of tiering might increasingly be warranted as asset purchases continue to add to reserves. Whether the ECB sees it this way too, is a different matter.

Conclusion

Initially, tiering was calibrated in such a way that some 71% of reserves that banks hold involuntarily as a result of ECB asset purchases, was exempt from negative rates. At the time of writing, this share has dropped to just above 50%. With the ECB having committed to further asset purchases, involuntary reserves may increase by a few hundred billion more this year. As the negative rate-exempted allowance is linked to bank liabilities, it rises much more slowly, and thus shrinks as a share of involuntary reserves. Negative rate costs of involuntary reserves may double in 2021 compared to 2020. The question thus becomes increasingly pressing as to whether the ECB will revisit the tiering methodology. This will depend on whether the ECB considers the TLTRO arrangement exclusively to incentivise lending to the real economy as it officially states, or whether it considers the TLTRO to simultaneously serve the secondary goal of providing negative rate relief to banks as well.

This article originally appeared on THINK.ING.com