Is Facebook’s GlobalCoin worth the hype? Launching platform currencies is nothing new in itself. Yet the sheer scale that a Facebook coin could achieve should give businesses, competition authorities and (central) banks some food for thought.

What is GlobalCoin?

When Bitcoin was launched in 2009, it was heralded as the digital currency that would make banks and other traditional intermediaries obsolete. But lately, it’s been established behemoths that have been announcing their own coins. Earlier this year, JPMorgan announced its “JPM Coin” for wholesale purposes, and today brought more news on Facebook’s project to launch its own “GlobalCoin”. What to make of this?

It is important to clear up two misunderstandings.

- Firstly, coining a nice name for a platform currency sounds like clever marketing, which is well understood in some corporate boardrooms. Establish vague associations with cryptocurrency, and headlines are guaranteed. But, strictly speaking, cryptocurrencies are decentralised. This means that the money supply and the infrastructure are managed by the collective userbase, which in practice is represented by interest groups such as miners, developers and exchanges. On the other hand, with Facebook’s coin, there is one centralised party which issues and manages the coin on its own platform. Facebook could also manage the exchange rate of its coin to traditional fiat currencies, such as the euro and the dollar. So referring to GlobalCoin as a cryptocurrency is wrong, or at best irrelevant. How Facebook implements the coin at a technical level, on a blockchain or otherwise, is not relevant from an economic or monetary perspective.

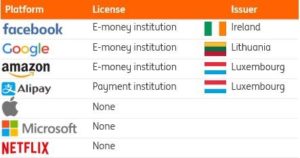

- Secondly, GlobalCoin as a currency issued on a platform, is nothing new. Many games have had their own virtual currencies for a long time. Prepaid telephone cards are another example. We know such currencies from the non-digital world as well. At a concert, you often need to buy custom coins to pay for beer. So nothing really new here. And because virtual currencies are not a new phenomenon, they are subject to well-established existing regulations. Indeed, Facebook acquired an “electronic money institution” license in Ireland in late 2016 and is allowed to issue and manage virtual currencies throughout the EU using that license.

“Nothing to see here people, please move on”?

Not quite. Even though Facebook’s currency project is nothing new in itself, the scale that a coin on Facebook’s platform could achieve is something to reckon with. It is clear where Facebook is getting its inspiration from. The Chinese WeChat app has been dubbed an “app for everything”. It includes a pay functionality, which means users can basically do everything on the platform and in the app. For Facebook, adding its own currency would provide a powerful incentive for its users to stay on the platform and to transact with suppliers there, paying them in Facebook’s virtual currency. This, in turn, would incentivise business suppliers to be present on Facebook’s platform and accept its coins, to avoid losing a significant chunk of their customers.

So while banks may find themselves disintermediated, business suppliers may in contrast be bound to Facebook’s platform. Competition authorities around the world are therefore probably watching Facebook’s moves closely. Central banks are probably watching, too. Launching virtual currencies on a modest scale has a negligible impact on monetary policy and financial stability. But if a lot of transactions end up being handled by what is, in effect, a foreign currency (insofar as its exchange rate is managed vis-à-vis a basket of currencies), central banks might want to think again.

This article first appeared on ING THINK.