Central banks the world over have piled into central bank digital currency (CBDC) research and piloting. Problems identified by central banks are real and justify a response. Yet it is actually far from clear that CBDC is always the best solution to address the problems raised. Particularly in Europe, other policy responses may yield the same or better outcomes. This article looks at four prominent justifications for CBDC in the Eurozone: the need for access to public money in a digital world, the threat of large online platforms, excess dependency on non-EU payment solutions, and geopolitical considerations.

The European Central Bank Central (ECB) argues that “it is imperative to ensure that [people] continue to have access to central bank money” in an increasingly digital world. Public money is needed as a ‘monetary anchor’” (ECB 2022). But is it indeed the case that “private” money (such as bank accounts we all know and use today) can only function if people have access to central bank-issued money, such as banknotes and coins? The ECB-commissioned Kantar study (2022) into people’s payment habits struggled with the fact that many people don’t realise, understand or care about the difference between central bank and commercial bank-issued money. So perhaps people are perfectly happy to pay with digital “private” money, knowing that the central bank continues to be at the centre of the system, with a wide array of tools to guarantee the stability of money.

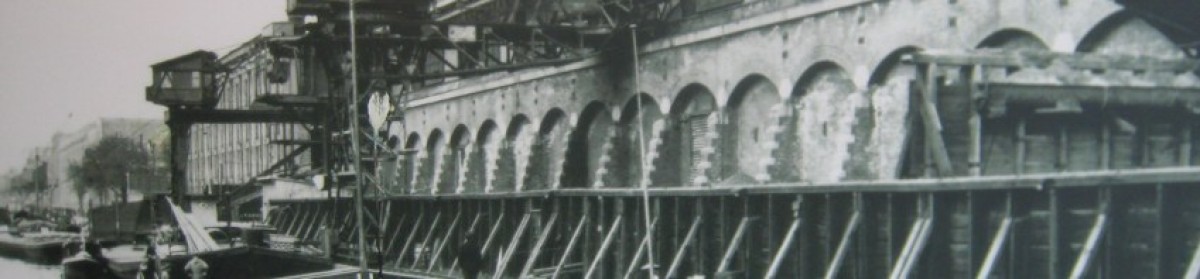

Large platforms are ideally positioned to integrate CBDC services into their payment system

The initial motivation for central banks to consider CBDC was to counter the threat of bigtech platforms issuing their own currency. Yet bigtechs issuing stablecoin not denominated in domestic currency, can effectively be addressed by regulation. The EU’s Markets in Crypto Assets Regulation (MiCAR) does exactly that, preventing such coins from becoming too large in payments. Meanwhile, domestically denominated stablecoins will require an e-money or banking license. Hence financial stability can be preserved by the full force of existing supervisory tools, and these coins are subject to domestic monetary policy as well. So why should CBDC be preferable over a well-regulated domestically denominated stablecoin?

But how then to prevent large online platforms from deploying digital currencies to increase user lock-in and further strengthen their dominant position? Well, legislative initiatives such as the Digital Markets Act seek to address this. And it is important to realise that platforms do not derive their lock-in power from issuing their own currency. Instead, they thrive by providing seamlessly integrated payments as part of an impeccable customer experience. As the BIS notes in a recent paper, a “core aspect of big tech business models is to run easy-to-use payment systems” (BIS 2022). In other words, it’s not about the underlying currency, it’s about the payment infrastructure on top of it. This means that a CBDC could in fact play into large platforms’ hands! Most of them are already licensed to act as Payment Service Provider. They are ideally positioned to integrate CBDC services into their payment systems, roll out solutions across Europe and thus further optimise their customer experience.

The digital euro is also positioned as a tool to avoid or reduce dependency on a small number of non-EU-based solutions. Yet here too the question arises whether the goal justifies the means. How is adding another form of digital currency going to help reducing existing dependencies? A CBDC will still need an infrastructure to actually use it for payments. A better targeted response to the concern of excess dependency would be to develop an alternative EU-based payment scheme for digital and online payments. Such a scheme could then process commercial bank money, stablecoin and even crypto payments – no CBDC needed.

Finally, an opportunity identified by policymakers is the possible use of CBDC as a tool to strengthen the euro’s position on global trading and financial markets. Yet a CBDC focused on a domestic retail audience, such as the digital euro, is unlikely to make an impact on such global markets. To strengthen the international role of the euro, a focus on large-value, cross-border and cross-currency payments would be needed.

Indeed the ECB and other central banks are looking into what is called “wholesale CBDC”, while private parties are also investigating digital currency platforms backed by central bank reserves. Yet wholesale digital currencies have very different characteristics and requirements than the retail variety. They are therefore generally treated as separate projects.

In short, while central banks and policymakers have put a number of very valid concerns on the agenda, it is highly doubtful whether a retail-focused CBDC is a sufficient or even necessary answer.

Article first appeared in Eurofi "Views" Magazine, August 2022.