The US, the UK and the euro area are now in the seventh year following the financial crisis. Are the seven lean years over, financially speaking? This is the question I seek to answer in this report. Here are the main conclusions:

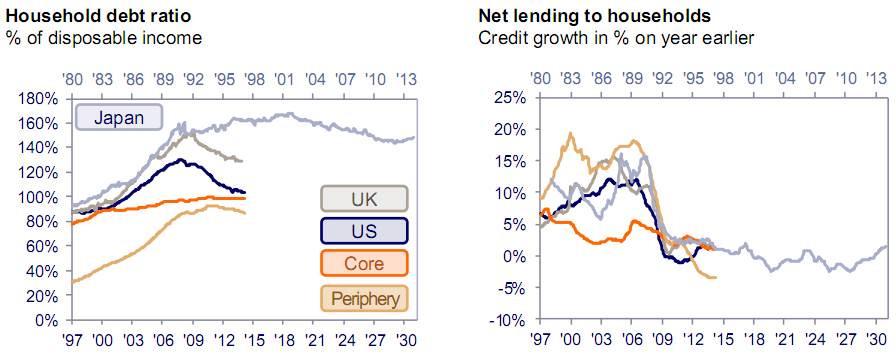

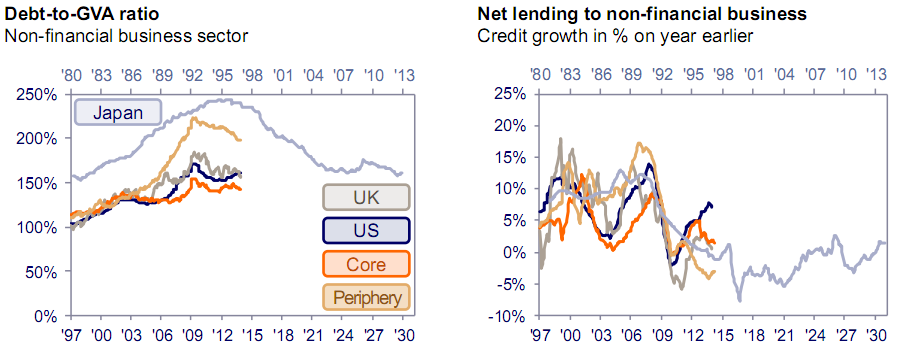

- In both the household and non-financial business sectors, only the Eurozone periphery is actually reducing debt. The US, UK and euro area core are deleveraging by growing income. In the Eurozone periphery however income is stagnating.

- The US, UK and Eurozone core compare favourably with Japan in the 1990s, where household debt ratios stagnated and business deleveraging was slow. Especially in the Eurozone periphery business sector, deleveraging may not be over.

Japan on upper time scale, UK/US/Eurozone on lower time scale. GVA = gross value added.

- Deleveraging however does not preclude growth. This is important especially for the Eurozone periphery.

- Corporate debt issuance has partly compensated for the slowdown in bank lending and stagnation of securitisation in most countries. But banks still account for over half to two-thirds of credit outstanding in Europe. This figure is less than one-third in the US

Have a look at the whole report (its 18 slides make it easy to digest) and let me know what you think!

Thanks, nice food for thought while in my Dar es Salaam traffic jam. Are you measuring deleveraging in two different ways: absolute change in lending or change in % of income? Last one seems best but you get different outcomes.

Thanks Ewout. The main focus of the report is on % of income, as in the end it is the capacity to service debt (out of cash flows) that matters. But on slide 4 and 9 I do decompose the change in the ratios in a numerator (absolute debt change) and denominator (income growth) effect. It is on those slides that you see startling differences: the eurozone periphery deleverages by reducing debt, while US, UK and eurozone core deleverage primarily by growing income.

The lesson is clear: economic growth is the “easiest” way to keep debt burdens manageable — actually reducing the nominal amount of debt outstanding is a slow and painful process…